Investment life insurance is a type of policy that combines life insurance coverage with investment components. In addition to providing a death benefit, these policies also offer the opportunity for the policyholder to accumulate cash value over time through investment options.

This can provide potential growth and a source of funds that can be accessed during the policyholder’s lifetime. Investment life insurance can be a valuable tool for individuals looking to protect their loved ones financially while also potentially building wealth.

By considering their long-term financial goals and risk tolerance, individuals can determine if investment life insurance aligns with their overall financial strategy. It is important to carefully review the terms and conditions of the policy and work with a qualified financial advisor to ensure it meets personal needs and objectives.

What Is Investment Life Insurance?

Investment life insurance is a type of insurance that combines life coverage with an investment component. With this policy, a portion of the premium paid goes towards providing a death benefit to beneficiaries, while the remaining funds are invested to potentially grow over time.

The concept behind investment life insurance is to offer individuals the opportunity to not only provide financial protection for their loved ones in the event of their death but also to accumulate savings or build cash value. Unlike traditional life insurance, which focuses primarily on risk coverage, investment life insurance offers the additional benefit of potential investment returns.

By investing in a variety of assets such as stocks, bonds, or mutual funds, policyholders have the chance to build wealth over the long term. This key distinction makes investment life insurance a popular choice for those looking to safeguard their family’s future while also growing their assets.

Benefits Of Investment Life Insurance

Investment life insurance offers several benefits, including building wealth over time and securing your future. One advantage is the tax advantages it provides, allowing you to potentially grow your investment without incurring additional tax burdens. By diversifying your investment portfolio, you can protect your financial well-being and hedge against potential risks.

With investment life insurance, you have the opportunity to accumulate cash value, which can provide liquidity and flexibility. As you continue to contribute to your policy over time, you can take advantage of the compounding effect, potentially maximizing returns on your investment.

This type of life insurance also offers death benefit protection, ensuring that your loved ones are financially secure in the event of your passing. Overall, investment life insurance can serve as a valuable tool for long-term financial planning and wealth accumulation.

Types Of Investment Life Insurance

Investment life insurance offers various options for individuals looking to combine life insurance with investment opportunities. One popular type is variable life insurance, which allows policyholders to invest their premiums in different investment options such as stocks, bonds, and mutual funds.

This type of policy offers the potential for higher returns but also comes with higher risks. Another option is universal life insurance, which provides a cash value component that policyholders can use to accumulate savings and earn interest over time.

Indexed universal life insurance is a variation of universal life insurance that ties the cash value growth to a specific stock market index. This allows policyholders to potentially benefit from market gains while protecting them from market downturns. With these different types of investment life insurance, individuals have the opportunity to secure their financial future while also growing their wealth.

Assessing Your Financial Goals And Needs

Understanding your long-term objectives is crucial when assessing your financial goals and needs. Evaluating your risk tolerance is equally important. By carefully considering your objectives, you can make informed decisions about investment life insurance. This type of insurance provides financial protection and enables you to grow your wealth simultaneously.

It is essential to be mindful of your risk appetite and whether you prefer a conservative or aggressive approach. Taking into account your long-term goals and risk tolerance will help you select the most suitable investment life insurance policy. Whether you prioritize wealth accumulation, retirement planning, or leaving a legacy for your loved ones, investment life insurance can support your financial aspirations.

Adaptability and flexibility are key factors to consider when choosing an investment life insurance policy. With careful evaluation, you can ensure that this financial strategy aligns with your unique circumstances and objectives.

Researching Insurance Providers

Researching insurance providers allows you to compare different companies’ offerings effectively. By reading customer reviews and ratings, you can gather valuable insights and make informed decisions. Before making an investment in life insurance, it is essential to take the time to research and explore the options available.

This will help ensure that you are selecting the right policy that meets your specific needs. By comparing the offerings of different companies, you can find the best combination of coverage, cost, and customer service. Pay attention to customer reviews and ratings as they provide real-world experiences and opinions.

Making an informed decision based on thorough research will give you peace of mind and confidence in your investment choice. Take the time to thoroughly research insurance providers to make the most of your investment in life insurance.

Analyzing Policy Features And Fees

Investment life insurance is a policy that offers not only life coverage but also investment opportunities. By analyzing the policy’s features and fees, individuals can make informed decisions. The investment options and flexibility provided by this type of insurance are crucial factors to consider.

It’s important to carefully review and understand the costs and charges associated with the policy. This will ensure that you are aware of any fees or expenses that may affect your investment returns. Take the time to compare different policies and their associated costs before making a decision.

By doing so, you can choose an investment life insurance policy that best aligns with your financial goals and preferences. So, be diligent in evaluating the features and fees of investment life insurance policies to make an informed choice.

Diversifying Your Investment Portfolio

Investment life insurance offers a way to diversify your investment portfolio by allocating funds across different asset classes. Balancing risk and reward is essential in this strategy. By spreading your investments across various assets such as stocks, bonds, real estate, and more, you can reduce the impact of any single asset’s performance on your overall portfolio.

This diversification helps protect your investments from significant losses and can potentially increase your returns over the long term. With investment life insurance, you have the opportunity to leverage the benefits of both insurance protection and investment growth. By carefully selecting and managing your investments, you can create a balanced portfolio that aligns with your financial goals and risk tolerance.

Consider consulting with a financial advisor to determine the best investment life insurance options for your individual needs.

Maximizing Tax Efficiency

Investment life insurance offers an opportunity to maximize tax efficiency by taking advantage of tax-deferred growth. With tax-deferred growth, your investments have the potential to grow faster since taxes on gains are postponed until withdrawal. Another benefit is the ability to make tax-free withdrawals when needed.

This flexibility allows you to access funds without incurring additional taxes or penalties. By opting for investment life insurance, you can effectively optimize your tax strategy and potentially enhance the growth of your investments. Planning for your future has never been easier with the combination of investment opportunities and tax advantages offered by investment life insurance.

Secure your financial wellbeing today and explore the benefits of investment life insurance.

Continually Monitoring And Adjusting Your Policy

In order to successfully navigate the world of investment life insurance, it is crucial that policyholders continually monitor and adjust their policies. One key aspect of this process is regularly reviewing the investment performance of the policy. By analyzing how the investments are performing, policyholders can make any necessary changes to ensure that their policy aligns with their goals.

This may involve reallocating funds, diversifying investments, or considering other investment options altogether. Continual monitoring and adjustment allow policyholders to optimize their investment life insurance and make the most of their financial goals. By staying proactive and regularly assessing the performance, policyholders can ensure that their investments are on track for long-term success.

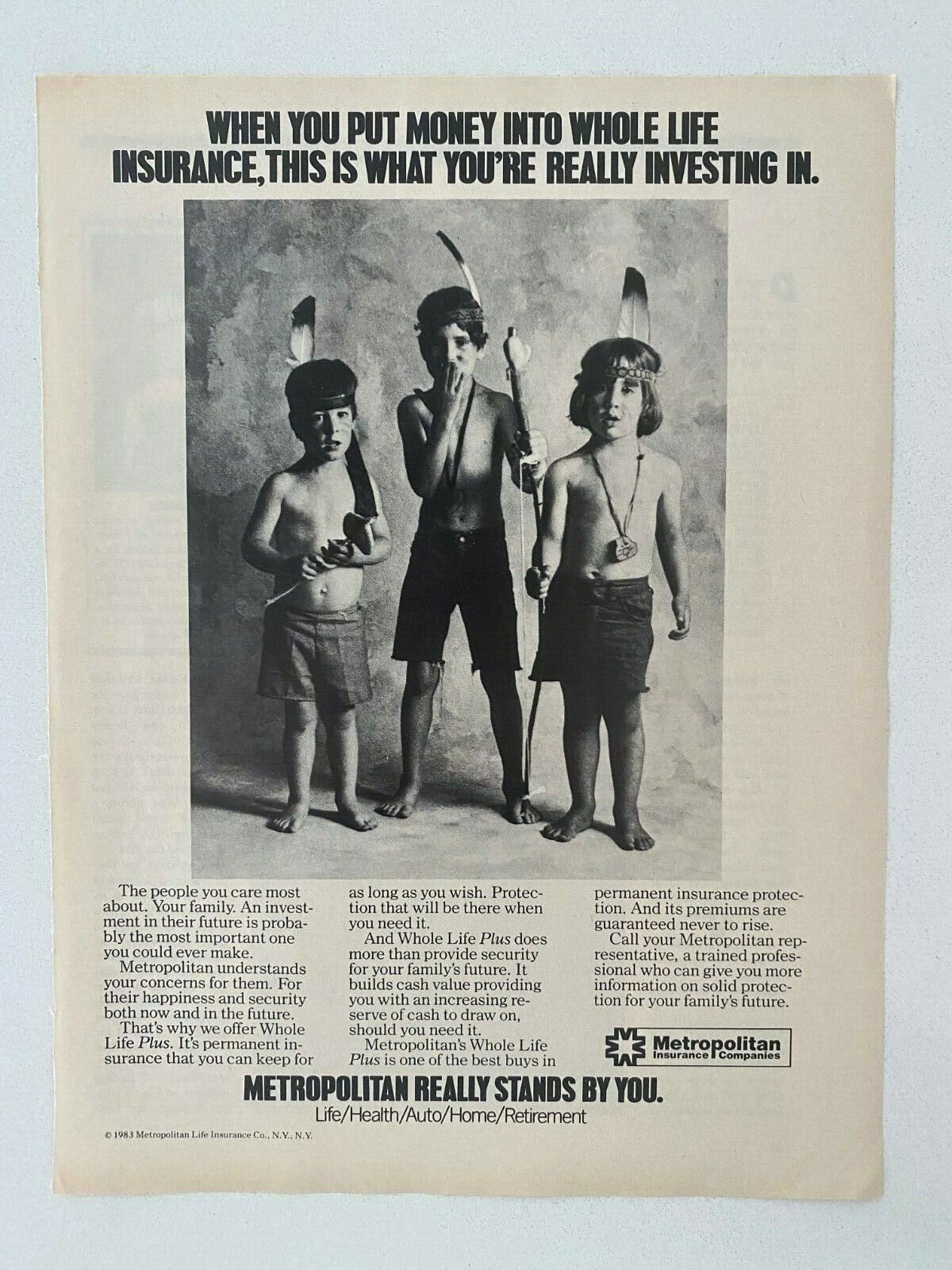

Credit: www.ebay.com

Conclusion

Investment life insurance can be a strategic financial tool that offers dual benefits of insurance coverage and investment growth potential. By combining the security of life insurance protection with the opportunity to grow wealth, it provides individuals with a comprehensive solution for their long-term financial needs.

The flexibility to choose from a variety of investment options allows policyholders to tailor their investment strategy to their specific goals and risk tolerance. Additionally, investment life insurance offers potential tax advantages, making it an attractive option for those seeking to maximize their financial resources.

It’s important to carefully evaluate different policies and options before making a decision, considering factors such as fees, investment performance, and the financial stability of the insurance provider. Ultimately, investment life insurance can play a valuable role in your overall financial plan, providing both peace of mind and the potential for long-term financial growth.